Are you considering investing your hard-earned money but unsure about the credibility of certain investment platforms? Acorns, the popular micro-investing app, may have caught your attention. However, with the abundance of information and misconceptions on the internet, it’s important to separate fact from fiction before diving into any investment.

In this blog post, we will address the burning questions surrounding Acorns. We’ll explore topics such as whether Acorns is a pyramid scheme, why it deducts money from your account, the safety of your investments, tax implications, and much more. So, if you’re on the fence about Acorns or just curious about its legitimacy, keep reading to find out everything you need to know.

But first, let’s settle one thing straight away: Acorns is not a pyramid scheme! Contrary to misconceptions, Acorns operates as a legitimate investing platform focused on helping individuals save and invest for their future. With that misconception debunked, let’s dig deeper and answer your most pressing questions about Acorns.

Is Acorns a Pyramid Scheme

In this subsection, we will dive deep into the question of whether Acorns is a pyramid scheme or not. Now, before we proceed, let’s clarify that we’re here to entertain you, inform you, and maybe even make you chuckle a bit. So, grab your popcorn and let’s get started!

What’s All the Buzz About Acorns

Acorns, if you haven’t heard of it yet, is a popular micro-investing app that allows you to invest spare change from your everyday purchases. It’s designed to make investing easy, accessible, and dare we say, fun! But of course, with popularity comes scrutiny, and one question that frequently pops up is whether Acorns is just another sneaky pyramid scheme in disguise.

Debunking the Pyramid Scheme Myth

Well, fear not, my financially curious friend! Acorns is not a pyramid scheme. Let’s clear the air and debunk this myth once and for all.

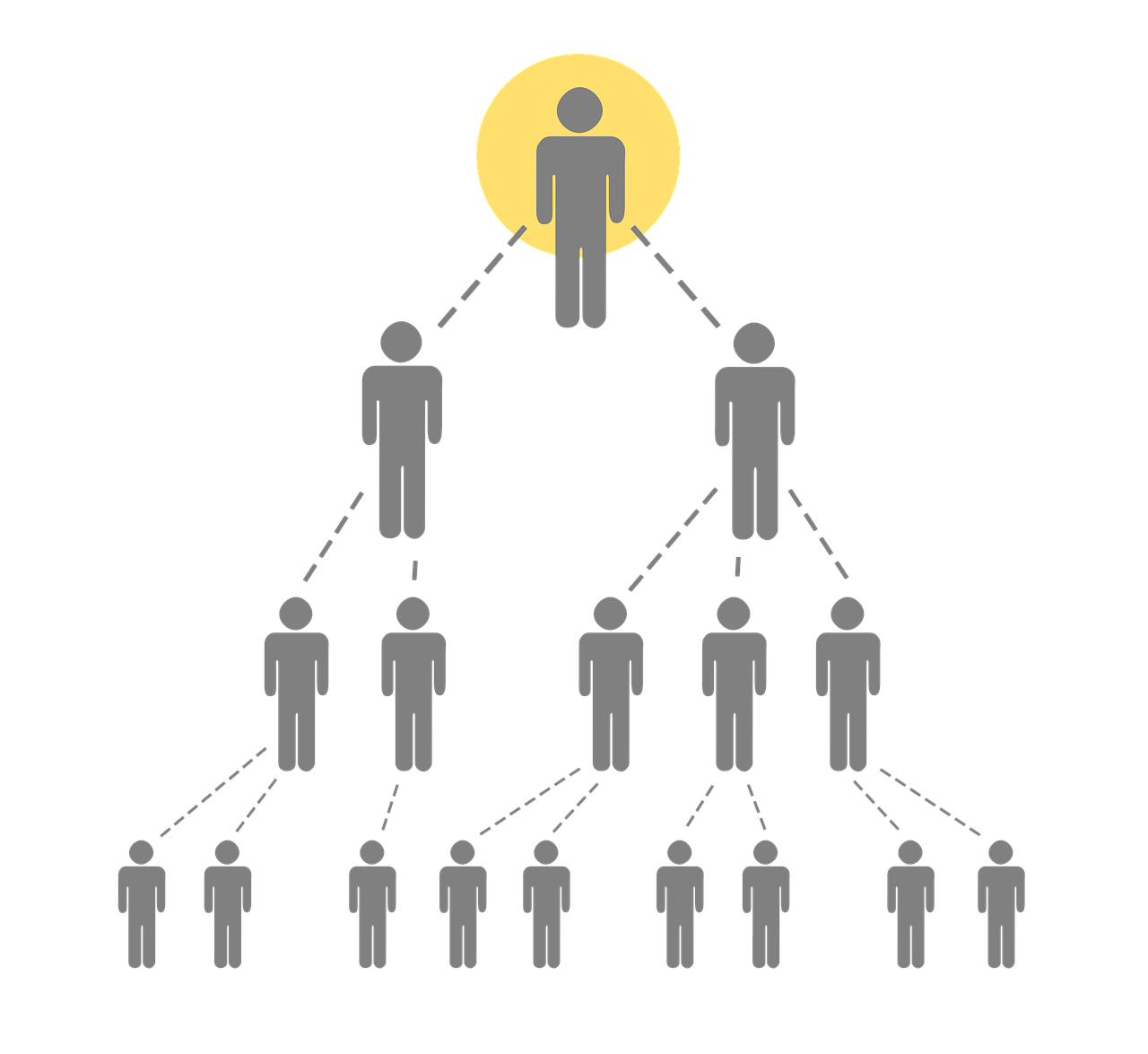

Pyramid Schemes: A Brief Reminder

Before we dive in, let’s quickly recap what a pyramid scheme actually is. Pyramid schemes operate by recruiting members who make payments to others higher up in the pyramid. The focus is typically on recruitment rather than the actual sale of products or services. These schemes often collapse when there are not enough new recruits to sustain the payouts.

No Recruitment, Just Investments

Now, here’s the thing – Acorns is all about investing, not recruitment. It doesn’t rely on a complicated hierarchy or require you to recruit other people into the system. Instead, Acorns helps you invest your spare change by rounding up your purchases, so you can grow your money over time.

Fees, Not Pyramid Tops

To further squash any pyramid scheme suspicions, Acorns clearly discloses its fee structure. There are no mysterious hidden costs or complex compensation plans. Acorns simply charges a small monthly fee based on your account size. So, rest assured, the fees are for the service you’re receiving, not for any pyramid-shaped payouts.

The Acorns Advantage

Now that we’ve debunked the pyramid scheme myth, let’s explore some of the advantages of using Acorns as your investment tool of choice.

Convenience and Accessibility

Acorns is all about making investing effortless. With a few taps on your smartphone, you can start investing your spare change. No need to be an expert stock-picker or financial guru. Acorns takes care of the heavy lifting for you, so you can sit back, relax, and watch your investment portfolio grow.

Diversification Made Simple

Through its automated system, Acorns spreads your investments across a diversified portfolio. This means your money is allocated to different asset classes, reducing the risk associated with putting all your eggs in one basket. So, even if the market takes a temporary dip, your investments are spread out in a way that mitigates potential losses.

Learning While You Earn

Acorns also offers educational resources and content to help you learn more about investing and personal finance. It’s like getting a crash course in money matters while watching your investments grow. So, by the time you retire, you’ll not only have a healthy nest egg but also a wealth of financial knowledge.

Wrap Up

So, there you have it! Acorns is definitely not a pyramid scheme. It’s a user-friendly, innovative app that encourages small steps toward building wealth over time. Whether you’re a beginner investor or simply someone looking to make the most of your spare change, Acorns could be your ticket to financial success.

Now, keep in mind that investing always comes with inherent risks, and past performance is not indicative of future results. It’s always a good idea to do your own research and consult with a financial advisor before making any investment decisions.

Happy investing and remember, it’s better to see your money grow in Acorns than let it gather dust under your mattress!

FAQ: Is Acorns a Pyramid Scheme

Answering the Burning Questions About Acorns

Welcome to the much-anticipated FAQ section where we dive into the most pressing concerns about Acorns. Rest assured, we’ve got you covered with all the information you need to make informed decisions and truly understand what Acorns is all about.

Is Acorns Invest an IRA

Acorns Invest is not an IRA (Individual Retirement Account). It is an investment app that allows you to invest pocket change in exchange-traded funds (ETFs). While Acorns Later does offer IRA accounts, Acorns Invest is designed for non-retirement investments.

Why Does Acorns Keep Taking My Money

Fear not, my friend, for Acorns isn’t in the business of swiping your hard-earned cash! Acorns uses a nifty feature called “Round-Ups” that automatically invests your spare change from everyday purchases. So, if you notice those funds disappearing, they’re just being diligently invested on your behalf.

What’s Better Than Acorns

Ah, the age-old question! While Acorns is a popular choice for beginning investors, there are plenty of alternatives out there. Robinhood, Stash, and Betterment are a few options worth exploring. Each has its own unique features and benefits, so take the time to do a little research and find the best fit for your investment goals.

Do I Have to Pay Taxes on Acorns

Taxes, the unavoidable reality of life, right? When it comes to Acorns, you may be subject to taxes on the gains realized from your investments. Keep in mind that if you sell investments with a profit, you may be liable for capital gains taxes. However, before you start panicking, consult a tax professional who can provide personalized advice based on your specific situation.

Will I Get a 1099 from Acorns

Ah, the famous 1099! If you’ve earned dividends, realized capital gains, or earned other taxable income through your Acorns investments, then yes, you will receive a 1099 form. Acorns will send you a 1099-DIV for any dividends over $10 and a 1099-B for any capital gains over $20. Be sure to keep an eye out for this form during tax season!

Is Acorns Safe and Legit

Absolutely! Acorns is not only safe but also legit. They utilize advanced security measures, including 256-bit encryption and Secure Sockets Layer (SSL), to protect your personal and financial information. Additionally, Acorns is a registered broker-dealer with the Securities and Exchange Commission (SEC), so you can trust them to handle your investments with care.

How Do You Get Rid of Acorns

Wait, you want to get rid of Acorns? We’ll be honest, we’re a little hurt. But hey, we understand that circumstances change! If you want to say farewell to Acorns, simply log into your account, navigate to the settings menu, and select the option to close your account. Keep in mind, though, that any investments you’ve made will need to be sold before you can fully close your account.

Should I Give Acorns My SSN

Yes, just as you would provide your Social Security Number (SSN) when opening a bank account or other financial services, you’ll need to do the same with Acorns. This is a standard requirement to verify your identity and ensure compliance with regulatory measures. Rest assured, Acorns takes the protection of your SSN and personal information seriously.

Are Acorns Safe Early

Morning, night, or anything in between, Acorns is safe at all times! Just like a seed needs time to grow into a mighty oak, your investments with Acorns need time to mature. Keep in mind that investing is a long-term game, and while there may be ups and downs along the way, Acorns is designed with the goal of helping your money grow over time.

Which Is Better: Robinhood or Acorns

Ah, the eternal struggle of choosing between two worthy contenders! It ultimately depends on your preferences and investment goals. Robinhood offers commission-free trades and a wide range of investment options, while Acorns focuses on automated investing and easy-to-use features. Take the time to explore both platforms and see which one aligns better with your needs.

What Investing App Is Best

There’s no shortage of investing apps out there, each with its own strengths and quirks. While it’s difficult to pinpoint the “best” one, some popular choices besides Acorns include Robinhood, Stash, and Betterment. It all boils down to your personal investment style and goals. Give a few options a test drive to see which one suits you best!

What Happens If I Delete Acorns

Well, if you decide to delete Acorns, it’s like saying goodbye to a financial friend. But hey, we’re not here to judge! If you choose to remove the app from your device, your Acorns account will remain active. However, it’s worth noting that to fully close your account, you’ll need to follow the steps outlined earlier in this FAQ section.

Is Acorns a Roth IRA

Acorns Later, a feature within the Acorns app, does offer Roth Individual Retirement Accounts (IRAs). With a Roth IRA, you can invest after-tax money, and any qualified withdrawals in retirement are tax-free. So, if you’re keen on a Roth IRA, Acorns Later may be right up your alley!

Is Acorn or Stash Better

Ah, the great debate! Acorns and Stash are both solid investment platforms, but their approaches differ slightly. Acorns focuses on automated investing and round-ups, while Stash emphasizes education and personalized investment themes. Take some time to evaluate your preferences and investment goals to determine which one suits you better.

Is Acorns Good for the Long Term

Absolutely! Acorns was designed with long-term goals in mind. By consistently investing over time, you harness the power of compounding returns, which can help grow your investments steadily. Whether you’re saving for retirement, a down payment, or a distant dream, Acorns can be a valuable tool in your long-term investing journey.

Did Acorns Get Hacked

Well, let’s put those hacking concerns to rest! To date, Acorns has not experienced any major security breaches. They employ robust security measures and encryption protocols to safeguard your information. But as with any online platform, it’s always a good idea to practice basic cybersecurity hygiene, such as using unique passwords and enabling two-factor authentication, to further protect your account.

Do Acorns Actually Invest

Absolutely! Acorns isn’t just a digital piggy bank. Once you link your bank accounts, Acorns automatically rounds up your everyday purchases to the nearest dollar and invests the spare change into a diversified portfolio of ETFs. It’s a clever and effortless way to start investing, even with small amounts.

How Much Should I Invest in Acorns

Well, that’s a personal decision! The beauty of Acorns lies in its flexibility. You can start with as little as $5 and continue contributing whatever amount you’re comfortable with. The key is consistency. Even small contributions can add up over time, thanks to the power of compounding. So, whether it’s $5 or $500, taking that first step is what counts!

Can You Lose Money with Acorns

Investing always involves a degree of risk, and Acorns is no exception. While the aim is to grow your investments, it’s important to remember that the value of your investments can fluctuate due to market conditions. However, Acorns does diversify your portfolio across hundreds of companies to help mitigate risk. Keep a long-term perspective, and remember that investing is a marathon, not a sprint.

Can You Get Rich on Acorns

Well, while we can’t promise yachts and private islands, Acorns can certainly help you grow your savings and potentially increase your wealth over time. The key is to set realistic expectations and not view it as a get-rich-quick scheme. By consistently investing and harnessing the power of compound returns, you can steadily build your financial future with Acorns.

Does Acorns Charge a Monthly Fee

Yes, Acorns does charge a monthly fee for its services. The fee structure depends on the type of account you have. Acorns Lite, which is the basic account, costs $1 per month, Acorns Personal (formerly Acorns Core) costs $3 per month and includes investment advising, and Acorns Family (formerly Acorns Core + Acorns Later) costs $5 per month. However, students get to enjoy the benefits of Acorns Lite without any fees!

Are Acorns FDIC Insured

While Acorns itself is not FDIC insured, they have partnered with various banks that hold your funds. Acorns Invest accounts are SIPC (Securities Investor Protection Corporation) insured up to $500,000 for securities and cash. So, in the unlikely event of a brokerage failure, your investments are protected.

Can You Cancel Acorns at Any Time

Absolutely! Acorns understands that circumstances change, so you can cancel your account at any time. Remember to liquidate your investments and withdraw any remaining funds before closing your account. Just make sure you’re certain about bidding Adieu to Acorns, as they would undoubtedly miss you and your investing adventures!

And there you have it, folks! We’ve tackled the most burning questions about Acorns and shed light on its inner workings, safety measures, and potential benefits. Whether you’re starting your investment journey, considering alternatives to Acorns, or pondering its long-term potential, we hope this comprehensive FAQ section has provided you with the knowledge you seek. Now, go forth and conquer the financial world with newfound confidence!